In recent years, family offices have expanded their investment horizons beyond traditional asset classes, such as stocks, real estate, and private equity. A growing trend among affluent families and their advisors is the exploration of alternative investments, including the captivating world of rare books. By venturing into this unique market, family offices are discovering the wealth of opportunities that rare books offer as tangible and culturally significant investments.

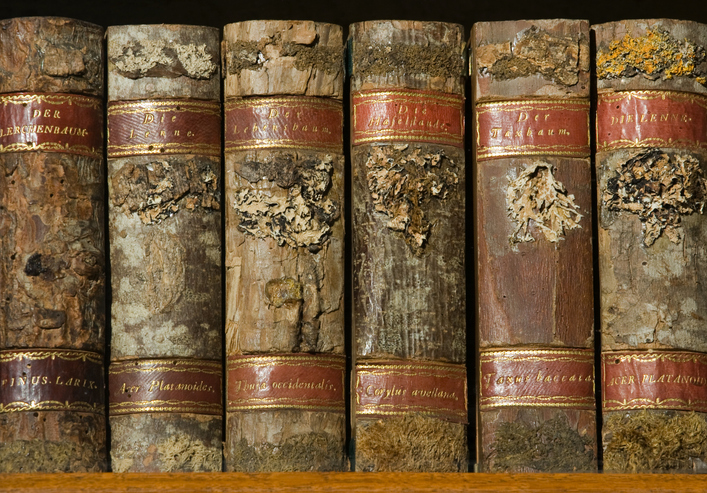

Rare books possess a unique appeal, combining historical significance, literary value, and scarcity. These timeless treasures are often coveted for their craftsmanship, age, authorship, or association with notable figures or historical events. Family offices are drawn to rare books as investments due to their potential for long-term appreciation and the ability to diversify their portfolios with tangible assets that have intrinsic value.

One of the key reasons why family offices are increasingly turning to rare books is their potential to preserve and grow wealth across generations. Unlike other financial instruments that are subject to market volatility, rare books offer a degree of stability and insulation from economic fluctuations. Well-preserved, rare editions from renowned authors or significant historical periods can appreciate in value over time, acting as a hedge against inflation and providing a secure store of wealth.

Family offices understand the importance of diversification to mitigate risk and protect their wealth. Rare books provide a unique opportunity to diversify their investment portfolios beyond traditional assets. By allocating a portion of their resources to rare books, family offices can balance their risk exposure and lessen the potential impact of market downturns. The scarcity and limited supply of rare books often insulate their value, offering an alternative investment that operates independently of broader market trends.

Investing in rare books is not merely a financial endeavor for family offices; it is also an exploration of intellectual and cultural capital. By acquiring significant literary works, family offices contribute to the preservation of human knowledge, history, and artistry. Rare books are a tangible connection to the past, holding the wisdom and insights of earlier generations. Family offices embrace the opportunity to support scholarship, research, and the dissemination of ideas by owning and preserving these remarkable artifacts.

Family offices are inherently concerned with generational wealth transfer and legacy planning. Rare books offer a unique avenue for intergenerational wealth transfer, providing an opportunity to pass down cherished and valuable items to future generations. The acquisition and preservation of rare books become an integral part of the family’s heritage, fostering a sense of identity and appreciation for culture and history.

The growing interest of family offices in investing in rare books underscores the enduring allure and inherent value of these literary treasures. Beyond financial gains, rare books offer a means for family offices to diversify their portfolios, preserve wealth across generations, and engage with intellectual and cultural capital. As family offices continue to explore alternative investments, the realm of rare books presents an opportunity to blend the past with the future, solidifying their legacies while contributing to the enrichment of global knowledge and heritage.